When it comes to trading in financial markets, knowing the best time to enter and exit a trade is essential for success. Investors and traders rely on various indicators to make informed decisions. These indicators can be technical or fundamental, and they help in predicting price movements, market trends, and potential returns. In this article, we will explore the best indicator for entry and exit in trading, their effectiveness, and how to use them for maximizing profits.

What are Entry and Exit Indicators?

Entry and exit indicators refer to tools or signals that assist traders in determining the optimal points to buy or sell a stock or other asset. These indicators analyze market trends and offer predictions based on historical data.

Importance of Best Indicator for Entry and Exit in Trading

Having accurate entry and exit points ensures you minimize losses and maximize profits. Poor timing can lead to significant losses, even if the overall market is favorable. Understanding the importance of these indicators gives traders a competitive edge.

Types of Entry and Exit Indicators

Moving Averages (MA)

Moving averages are one of the most commonly used indicators. Traders use it to smooth out price action and identify trends over a specific period.

Relative Strength Index (RSI)

The RSI measures the strength of a stock’s price relative to its past performance. It indicates overbought or oversold conditions, helping traders decide on their entry and exit points.

Bollinger Bands

Bollinger Bands consist of three lines: the upper, middle, and lower bands. These lines provide insights into the volatility of the market, helping traders identify potential buy or sell opportunities.

MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It helps traders identify bullish and bearish signals.

Stochastic Oscillator

This indicator compares a stock’s closing price to its price range over a specific period. It helps traders identify possible trend reversals, providing clues for entry and exit.

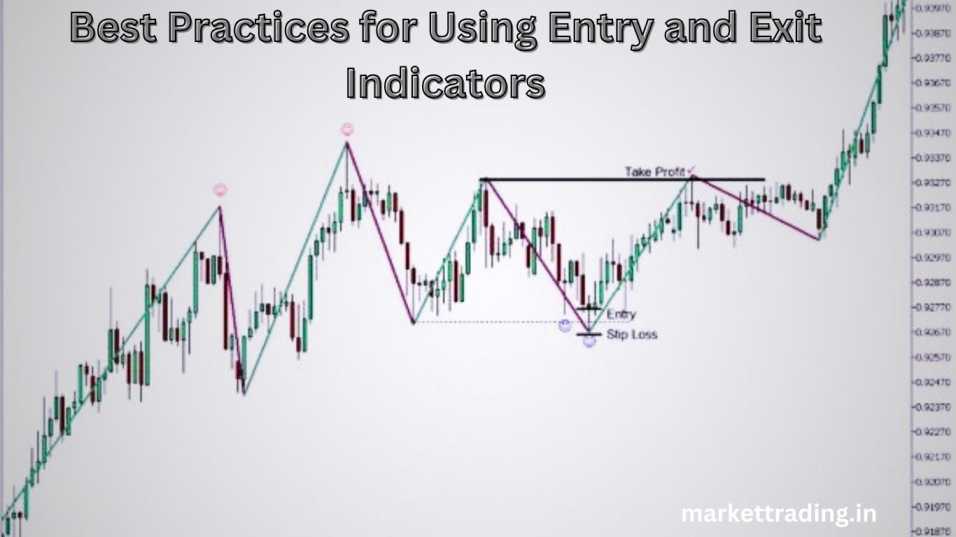

Best Practices for Using Entry and Exit Indicators

Combining Multiple Indicators

Relying on one indicator may not provide accurate results. Combining multiple indicators can offer a clearer picture and increase the chances of making a profitable trade.

Backtesting and Strategy Optimization

Before using any indicator, it’s important to backtest it on historical data to see how effective it has been. Adjusting strategies based on past performance improves future outcomes.

Moving Averages (MA): Simplifying Market Trends

The Moving Averages (MA) is an essential indicator for entry and exit in trading, primarily because it simplifies the complexities of market fluctuations. It helps traders spot the direction of the trend, whether upward or downward, by calculating the average price of a stock over a specific period, such as 20, 50, or 200 days.

Types of Moving Averages

There are two main types of Moving Averages:

- Simple Moving Average (SMA): This takes the arithmetic average of a stock’s price over a defined period.

- Exponential Moving Average (EMA): EMA gives more weight to recent prices, making it more responsive to new data.

How to Use Moving Averages for Entry and Exit

- Bullish Signal: When the short-term moving average (e.g., 20-day) crosses above the long-term moving average (e.g., 50-day), it signals a potential buy opportunity.

- Bearish Signal: Conversely, when the short-term moving average crosses below the long-term moving average, it indicates a sell opportunity.

Moving Averages work best in trending markets and help traders ride the wave of momentum without getting caught up in minor price swings.

Relative Strength Index (RSI): Identifying Overbought or Oversold Conditions

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify whether a stock is overbought or oversold.

Understanding RSI Levels

- RSI Above 70: This indicates that a stock is overbought, meaning its price might soon decrease. Traders may consider this a signal to exit or sell.

- RSI Below 30: This indicates that a stock is oversold, meaning its price might soon increase. This can be a good entry point for traders.

RSI is often used in combination with other indicators to confirm signals and avoid false alarms.

Bollinger Bands: Measuring Market Volatility

Bollinger Bands are a versatile indicator that helps traders measure market volatility. It consists of three lines: the middle band is a simple moving average, while the upper and lower bands represent standard deviations above and below the moving average.

How Bollinger Bands Work

- Price Near Upper Band: This suggests the asset is overbought, and a price reversal could be imminent, signaling a good time to sell.

- Price Near Lower Band: This suggests the asset is oversold, and a price increase could occur, making it a good buying opportunity.

Bollinger Bands are particularly useful for identifying periods of high or low volatility in the market.

MACD (Moving Average Convergence Divergence): Spotting Trend Reversals

The MACD is one of the most popular technical indicators used by traders to spot trend reversals and momentum shifts. It consists of two lines – the MACD line and the signal line – and a histogram.

Interpreting MACD Signals

- Bullish Signal: When the MACD line crosses above the signal line, it’s a signal to enter a buy trade.

- Bearish Signal: When the MACD line crosses below the signal line, it signals an exit or sell trade.

MACD is often used to confirm other indicators, such as moving averages and RSI, to make more accurate decisions.

Stochastic Oscillator: Timing the Market

The Stochastic Oscillator is a momentum indicator that compares the closing price of an asset to its price range over a set period. It is particularly useful for identifying potential trend reversals.

How to Use the Stochastic Oscillator

- Overbought Signal: When the Stochastic Oscillator is above 80, it signals that the asset is overbought and could soon experience a downturn.

- Oversold Signal: When the Stochastic Oscillator is below 20, it indicates that the asset is oversold and may soon rally.

This indicator is especially effective in ranging markets, helping traders pinpoint when to enter and exit trades with precision.

Combining Indicators for Better Accuracy

No single indicator is perfect. Each has its strengths and limitations. That’s why experienced traders often combine multiple indicators to reduce the chances of false signals and improve accuracy.

Example of Combining Indicators

- Use MACD to identify the trend direction.

- Confirm the signal with RSI to ensure the stock isn’t overbought or oversold.

- Use Bollinger Bands to analyze volatility before making the trade.

Combining indicators ensures that traders get a holistic view of the market, minimizing risks and maximizing opportunities.

How Market Conditions Affect Indicators

It’s essential to remember that market conditions, such as volatility and trading volume, affect the performance of entry and exit indicators. Trending markets may make Moving Averages and MACD more effective, while ranging markets may favor the use of Stochastic Oscillators and RSI.

Why Backtesting is Important

Backtesting is the process of testing a trading strategy on historical data to evaluate its effectiveness. This allows traders to refine their strategies before applying them in real-time markets.

Benefits of Backtesting

- Risk Management: It helps traders understand potential risks and avoid costly mistakes.

- Confidence Building: Backtesting provides evidence of a strategy’s performance, building confidence in its success.

Incorporating backtesting into your routine is crucial for improving trading results and minimizing losses.

Conclusion: Mastering Entry and Exit for Success

In the world of trading, timing is everything. Using the best indicator for entry and exit can help traders navigate the complexities of the market with greater confidence. Whether you’re using Moving Averages, RSI, Bollinger Bands, or MACD, mastering these tools and combining them effectively is key to long-term success.

Remember, trading is a skill that requires practice, patience, and continuous learning. By utilizing the right indicators, backtesting your strategies, and staying informed about market conditions, you can improve your decision-making process and enhance your trading performance.

FAQs About best indicator for entry and exit

What is the best indicator for entry and exit in trading?

There isn’t one perfect indicator, but a combination of indicators like MACD, RSI, and Bollinger Bands works best for many traders.

How can I improve my entry and exit timing?

Improving timing involves consistent practice, backtesting strategies, and using multiple indicators to confirm your decisions.

Should I always rely on technical indicators?

While technical indicators are valuable, you should also consider fundamental analysis and market news for a holistic view.

What is backtesting, and why is it important?

Backtesting involves testing a strategy using historical data to evaluate its effectiveness. It’s important for refining strategies before live trading.

Can beginners use entry and exit indicators?

Yes, beginners can use these indicators. It’s important to start simple and gradually incorporate more advanced tools as you gain experience.

What are the risks of relying too much on indicators?

Indicators can give false signals in volatile markets. Overreliance without proper analysis can lead to losses.